Life insurance is a financial safety net that can provide crucial support to your loved ones in the event of your untimely death. It offers a lump sum payment that can be used to cover expenses such as funeral costs, mortgage payments, or college tuition.

Types of Life Insurance

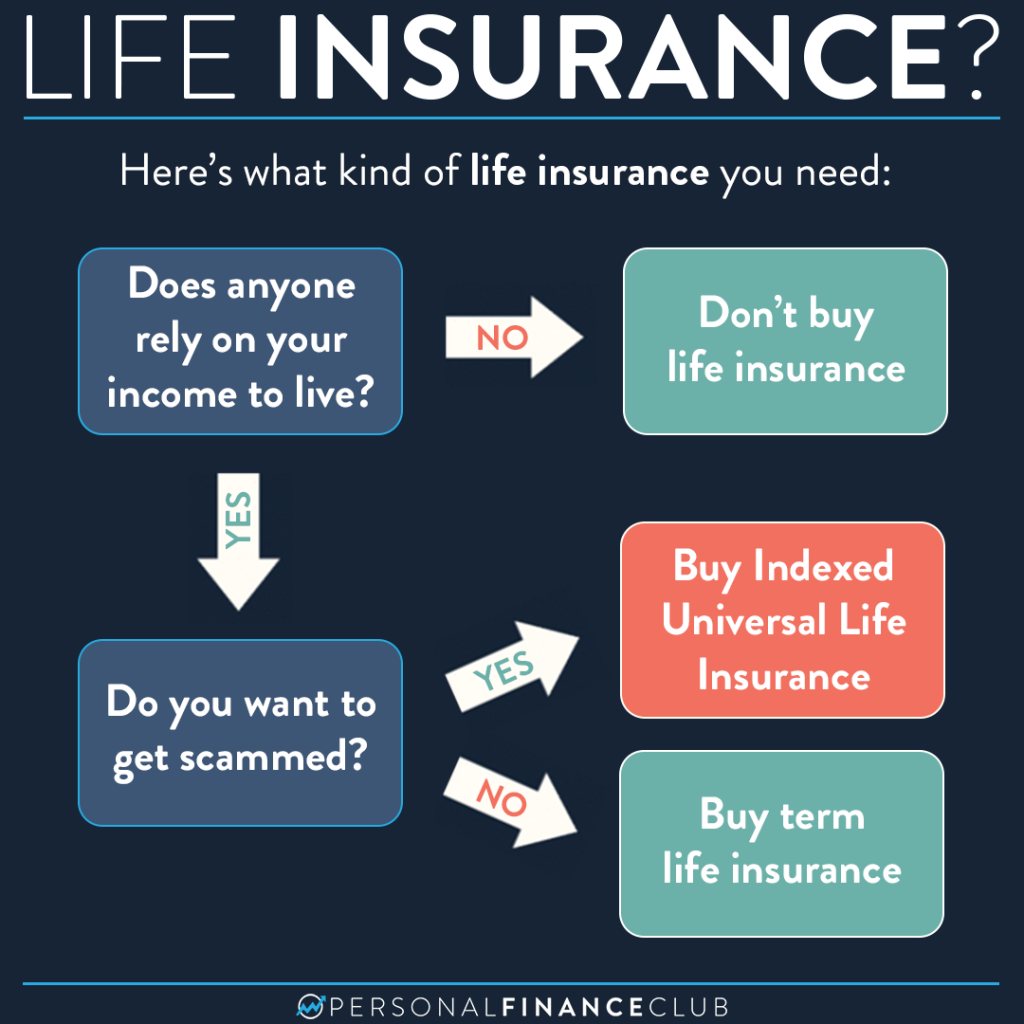

There are two main types of life insurance:

- Term life insurance: This provides coverage for a specific period of time. If you die within the term, your beneficiaries receive the death benefit. If you outlive the term, you receive nothing.

- Whole life insurance: This provides lifelong coverage. In addition to the death benefit, whole life policies also build cash value over time, which can be accessed through loans or withdrawals.

Factors to Consider When Choosing Life Insurance

When selecting a life insurance policy, consider the following factors:

- Coverage amount: Determine how much coverage you need to adequately protect your loved ones.

- Term length: If you choose term life insurance, decide on the appropriate length of coverage based on your needs.

- Premiums: Compare premiums from different insurers to find the best deal.

- Riders: Consider adding riders to your policy to enhance coverage, such as accidental death and dismemberment or critical illness.

- Insurer reputation: Research the financial stability and reputation of the insurance company.

Reasons to Consider Life Insurance

- Protect your loved ones financially: Life insurance can provide a much-needed financial cushion for your family in the event of your death.

- Cover funeral and other expenses: Life insurance can help cover the costs associated with your death, such as funeral expenses, medical bills, and debt.

- Provide for your children’s education: Life insurance can help ensure that your children have the funds they need for college.

- Create a legacy: Life insurance can be used to create a legacy for your family and future generations.

Life insurance is a valuable financial tool that can provide peace of mind and security for you and your loved ones. By carefully considering your needs and options, you can find a policy that best suits your circumstances.