Introduction

Basics of Insurance is a financial tool that protects individuals and businesses from unforeseen financial losses. It works on the principle of risk pooling, where a large number of people share the cost of potential losses. This article will delve into the fundamental concepts of insurance, helping you understand its importance and various types.

What Are the Basics of Insurance?

Insurance is a contract between an insurer and an insured. The insurer promises to compensate the insured for a specific loss in exchange for regular premium payments. This transfer of risk from the individual to the insurer provides financial protection.

Key Components of Insurance

- Policyholder: The individual or business purchasing the insurance policy.

- Insurer: The company providing the insurance coverage.

- Premium: The regular payment made by the policyholder to the insurer.

- Coverage: The scope of protection provided by the insurance policy.

- Claim: A request made by the insured for compensation due to a covered loss.

Basics of Insurance

Insurance can be categorized based on the type of risk covered:

- Life Insurance: Provides financial protection for beneficiaries upon the policyholder’s death.

- Health Insurance: Covers medical expenses incurred by the insured.

- Property Insurance: Protects against losses to property due to theft, fire, natural disasters, and other perils.

- Auto Insurance: Covers financial losses resulting from car accidents, theft, or damage to the vehicle.

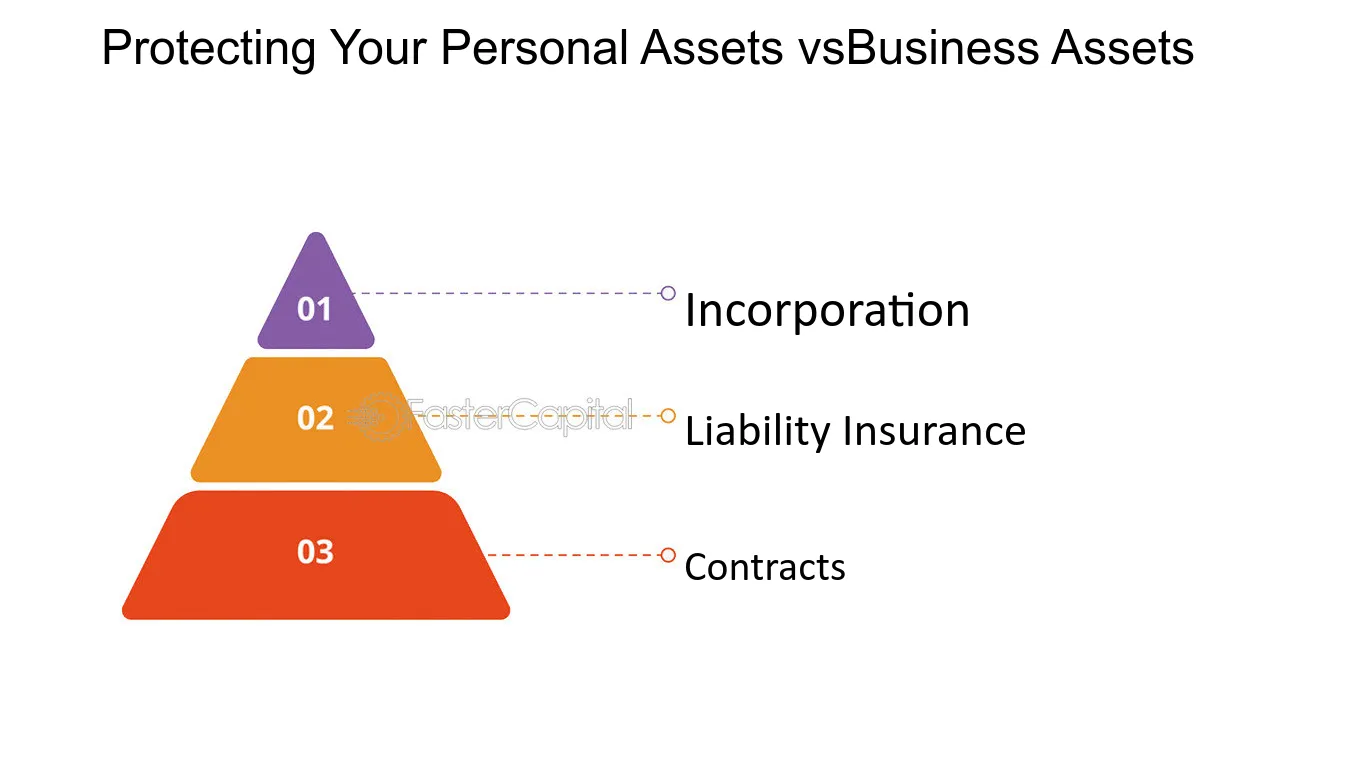

- Liability Insurance: Protects against claims of bodily injury or property damage caused by the insured.

- Business Insurance: Covers various risks faced by businesses, including property damage, liability claims, and business interruption.

- Travel Insurance: Protects against losses due to trip cancellations, medical emergencies, and baggage loss while traveling.

How Basics of Insurance Works

When you purchase an insurance policy, you are essentially transferring the risk of a financial loss to the insurance company. In return for regular premium payments, the insurer agrees to cover the loss if it occurs. If a covered loss happens, the insured submits a claim to the insurer. The insurance company investigates the claim and determines the amount of compensation to be paid.

Factors Affecting Insurance Premiums

Several factors influence the cost of insurance premiums:

- Age: Age is a significant factor in life and health insurance premiums.

- Health: Health conditions can affect health insurance premiums.

- Driving Record: Accidents and traffic violations impact auto insurance premiums.

- Property Value: The value of your property affects property insurance premiums.

- Coverage Limits: The higher the coverage limits, the higher the premium.

- Deductible: A higher deductible generally results in lower premiums.

Importance of Insurance

Insurance plays a crucial role in financial security. It provides peace of mind and protection against unexpected losses. By carefully selecting the appropriate insurance coverage, you can safeguard your assets, health, and well-being.

Conclusion

Understanding insurance is essential for making informed decisions about your financial protection. By comprehending the different types of insurance, how they work, and the factors affecting premiums, you can effectively manage risks and build a strong financial foundation.

[Insert relevant image of a family with insurance documents]

Keywords: insurance, risk, policyholder, insurer, premium, coverage, claim, life insurance, health insurance, property insurance, auto insurance, liability insurance, business insurance, travel insurance

Note: This is a basic overview of insurance. You can expand on specific types of insurance in separate articles to provide more in-depth information. Additionally, including case studies and real-life examples can make your content more engaging.