Selecting the best car insurance company is crucial for protecting your financial well-being and ensuring adequate coverage in the event of an accident. With numerous providers offering various plans and rates, it’s essential to carefully evaluate your options. Here’s a comprehensive guide to help you make an informed decision:

Key Factors to Consider

- Coverage: Assess the specific benefits offered by different plans, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Premiums: Compare monthly premiums from multiple insurers to find a plan that fits your budget. Consider additional costs such as deductibles, copays, and out-of-pocket maximums.

- Network: Ensure that your preferred repair shops or mechanics are within the insurer’s network.

- Discounts: Check if the insurer offers any discounts, such as safe driver discounts, good student discounts, or multi-car discounts.

- Customer Service: Research the insurer’s reputation for customer service and claims handling.

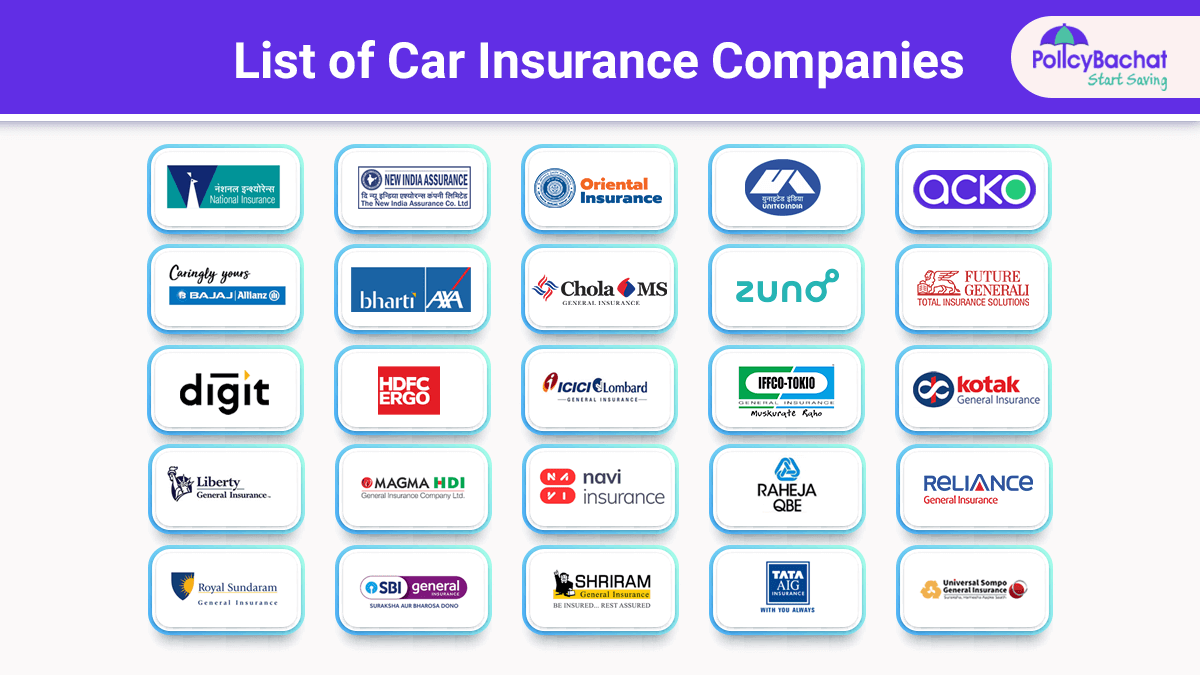

Leading Car Insurance Companies

While the insurance market is constantly evolving, here are some well-regarded companies known for their competitive rates, comprehensive coverage, and customer satisfaction:

- Geico: Known for its affordable rates and online convenience.

- Progressive: Offers a wide range of coverage options and personalized discounts.

- State Farm: A long-standing insurer with a strong reputation for customer service.

- Allstate: Provides a variety of insurance products, including auto insurance.

- USAA: A member-owned company that offers competitive rates and excellent service to military members and their families.

Tips for Finding the Best Car Insurance

- Shop Around: Get quotes from multiple insurers to compare prices and coverage options.

- Review Your Driving Record: A clean driving record can lead to lower premiums.

- Consider Your Vehicle: The make, model, and year of your car can impact your insurance rates.

- Evaluate Your Needs: Assess your driving habits, the value of your vehicle, and your financial situation to determine the appropriate level of coverage.

- Read the Fine Print: Carefully review the terms and conditions of each plan to understand any limitations or exclusions.

By carefully considering these factors and utilizing available resources, you can find the best car insurance company that meets your specific needs and provides you with peace of mind on the road.