Navigating the Complex World of Healthcare Insurance

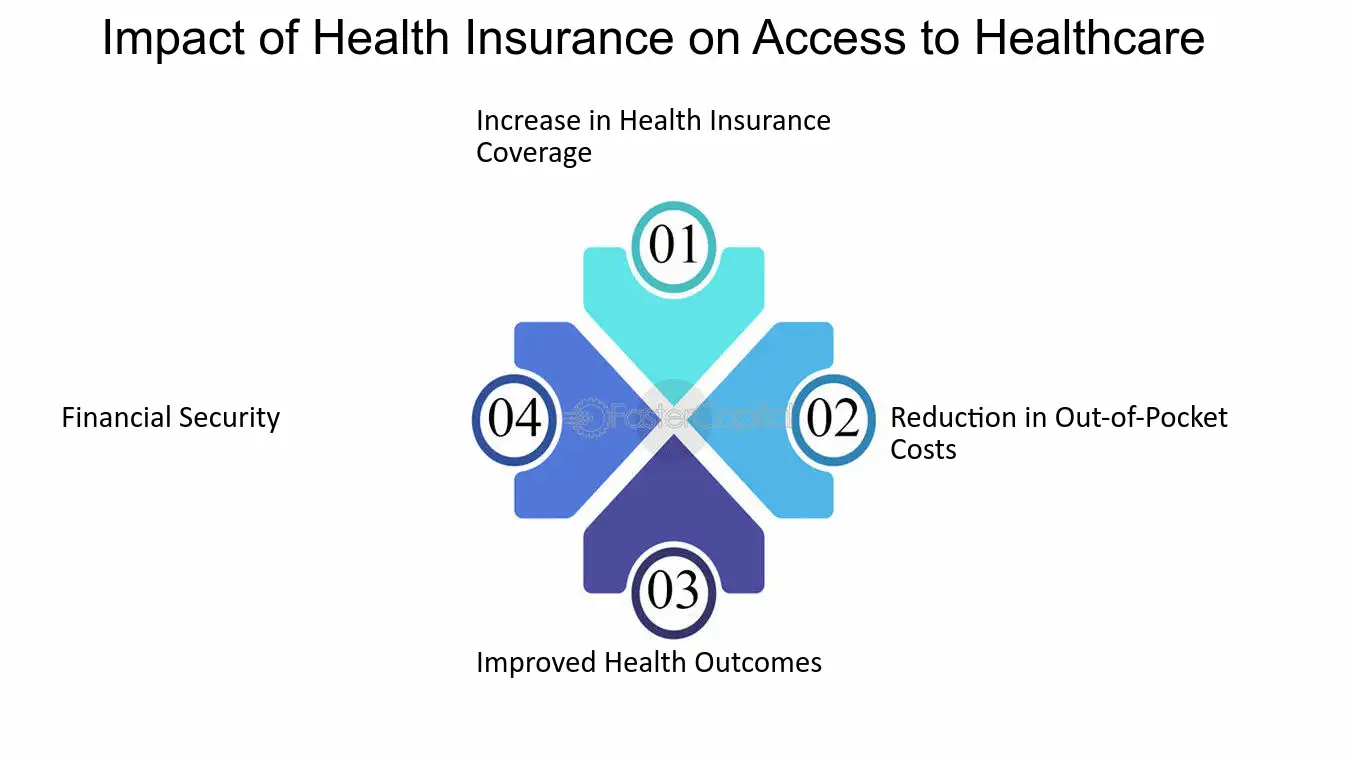

Selecting the appropriate health insurance plan can be a daunting task, especially when considering the vast array of options available. Understanding your specific needs, budget, and local healthcare providers is crucial in making an informed decision.

Key Factors to Consider:

- Coverage: Determine the type of coverage you require. Options include individual, family, employer-sponsored, Medicare, or Medicaid plans.

- Network: Ensure that your preferred doctors and hospitals are within the insurance provider’s network. A wider network generally offers more flexibility.

- Premiums: Compare monthly premiums from different insurers to find a plan that fits your budget. Consider any additional costs such as deductibles, copays, and out-of-pocket maximums.

- Benefits: Evaluate the specific benefits offered by each plan, including prescription drug coverage, mental health services, and preventive care.

- Pre-existing Conditions: If you have pre-existing health conditions, check if they are covered by the insurance plan.

Online Resources and Local Assistance:

- Health Insurance Marketplaces: These government-run marketplaces offer a variety of plans from different insurers. You may qualify for subsidies to help offset the cost.

- Insurance Agents and Brokers: Local insurance agents or brokers can provide personalized guidance and help you compare different plans.

- Employer-Sponsored Plans: If you’re employed, inquire about the health insurance options offered by your employer.

- Community Health Centers: These centers often offer affordable healthcare services and may be able to assist with insurance enrollment.

Tips for Finding the Best Plan:

- Start Early: Begin your research well in advance of your desired effective date.

- Review Your Needs: Assess your current and anticipated healthcare needs to determine the appropriate level of coverage.

- Compare Plans: Use online tools and comparison websites to compare different plans and find the best value.

- Read the Fine Print: Carefully review the terms and conditions of each plan to understand the limitations and exclusions.

By considering these factors and utilizing available resources, you can find a health insurance plan that meets your specific needs and provides you with peace of mind.