Introduction

Life insurance is a financial contract between an insurance policyholder and an insurer. It provides a sum of money (death benefit) to designated beneficiaries upon the policyholder’s death. This financial security can help your loved ones maintain their financial stability during a difficult time.

Keywords: life insurance, death benefit, beneficiaries, financial stability

Types of Life Insurance

There are several types of life insurance policies, each with its own features and benefits:

- Term Life Insurance: This policy provides coverage for a specific term (e.g., 10, 20, or 30 years). It is relatively inexpensive and offers a large death benefit.

- Whole Life Insurance: This policy provides lifelong coverage and accumulates a cash value over time. The death benefit remains constant, and you can borrow against the cash value.

- Universal Life Insurance: This policy combines features of term and whole life insurance. It offers flexible premiums and death benefits, and the cash value grows at a variable rate.

- Variable Universal Life Insurance: Similar to universal life policy, but the cash value is invested in various sub-accounts, allowing for higher returns but also higher risks.

- Endowment Life Assurance: This policy pays out a lump sum to the policyholder if they survive the policy term, or to beneficiaries if the policyholder dies.

Keywords: term life insurance, whole life insurance, universal life policy, variable universal Life Assurance, endowment life policy

How Life Insurance Works

When you purchase a Life Assurance policy, you agree to pay regular premiums. In return, the insurance company promises to pay a specified death benefit to your beneficiaries upon your death. The death benefit can be used to cover funeral expenses, outstanding debts, mortgage payments, or provide financial support for your dependents.

Keywords: life policy premium, death benefit, beneficiaries

Factors Affecting Life Assurance Premiums

Several factors influence the cost of your life policy premium:

- Age: Younger individuals typically pay lower premiums than older individuals.

- Health: Your overall health and medical history can impact your premium.

- Lifestyle: Factors such as smoking, occupation, and hobbies can affect your premium.

- Policy Type: The type of life policy policy you choose will determine the premium amount.

- Death Benefit: The higher the death benefit, the higher the premium.

- Policy Term: The length of the policy term affects the premium for term life policy.

Keywords: Life Assurance premium, age, health, lifestyle, policy type, death benefit, policy term

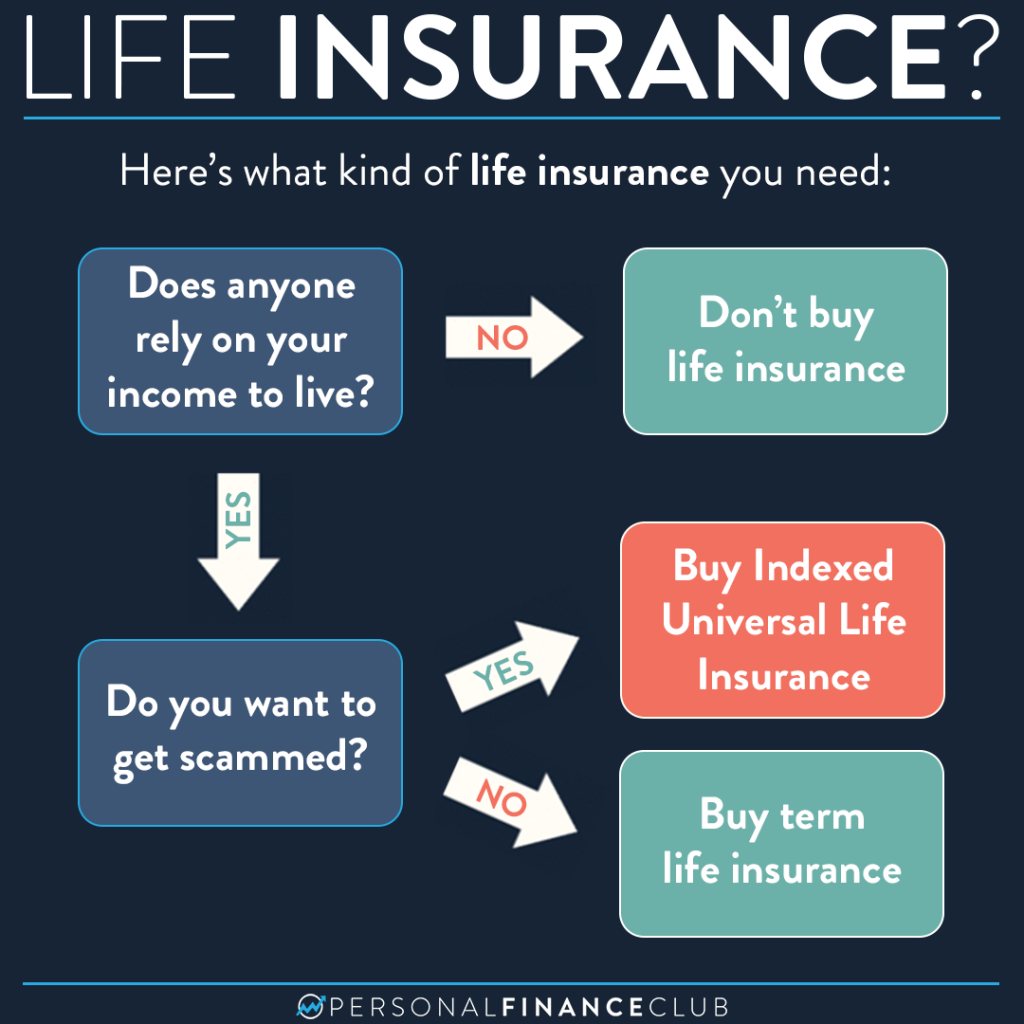

Choosing the Right Life Assurance Policy

Selecting the appropriate Life Assurance policy depends on your individual needs and circumstances:

- Assess Your Financial Situation: Determine how much Life Assurance coverage you need to protect your family’s financial future.

- Consider Your Budget: Evaluate your budget to determine the affordable premium amount.

- Review Your Health: Understand your health condition to assess potential premium impacts.

- Compare Policies: Obtain quotes from multiple insurers to compare coverage and prices.

Keywords: Life Assurance policy, financial situation, budget, health, compare policies

Life Insurance Riders

Many Life Assurance policies offer additional coverage through riders. These riders can provide extra protection and benefits:

- Accidental Death Rider: Pays an additional death benefit if the insured dies in an accident.

- Critical Illness Rider: Provides a lump sum benefit if the insured is diagnosed with a critical illness.

- Long-Term Care Rider: Offers coverage for long-term care expenses.

- Disability Income Rider: Provides income replacement if the insured becomes disabled.

Keywords: Life Assurance riders, accidental death rider, critical illness rider, long-term care rider, disability income rider

Life Assurance and Estate Planning

Life Assurance can be a valuable tool in estate planning. It can help cover estate taxes, provide liquidity for estate administration, and ensure a smooth transition of assets to beneficiaries.

Keywords: Life Assurance, estate planning, estate taxes, liquidity, beneficiaries

Tips for Buying Life Assurance

- Start Early: Purchasing Life Assurance at a young age can help you lock in lower premiums.

- Review Your Coverage Regularly: As your life circumstances change, reassess your insurance needs.

- Consider Life Assurance Alternatives: Explore other financial products like annuities or investments to supplement your Life Assurance coverage.

Keywords: life insurance, start early, review coverage, Life Assurance alternatives

Conclusion

Life Assurance is a vital component of financial planning. By understanding the different types of policies, factors affecting premiums, and the benefits they provide, you can make informed decisions to protect your loved ones’ financial well-being.

Keywords: life insurance, financial planning

Related Resources:

Would you like me to add more keywords or optimize the article further based on Yoast SEO’s recommendations?