Personal business insurance is a type of insurance that protects individuals who operate businesses from personal liability. It can be crucial for sole proprietors, freelancers, or individuals who run businesses from their homes.

Why is Personal Business Insurance Important?

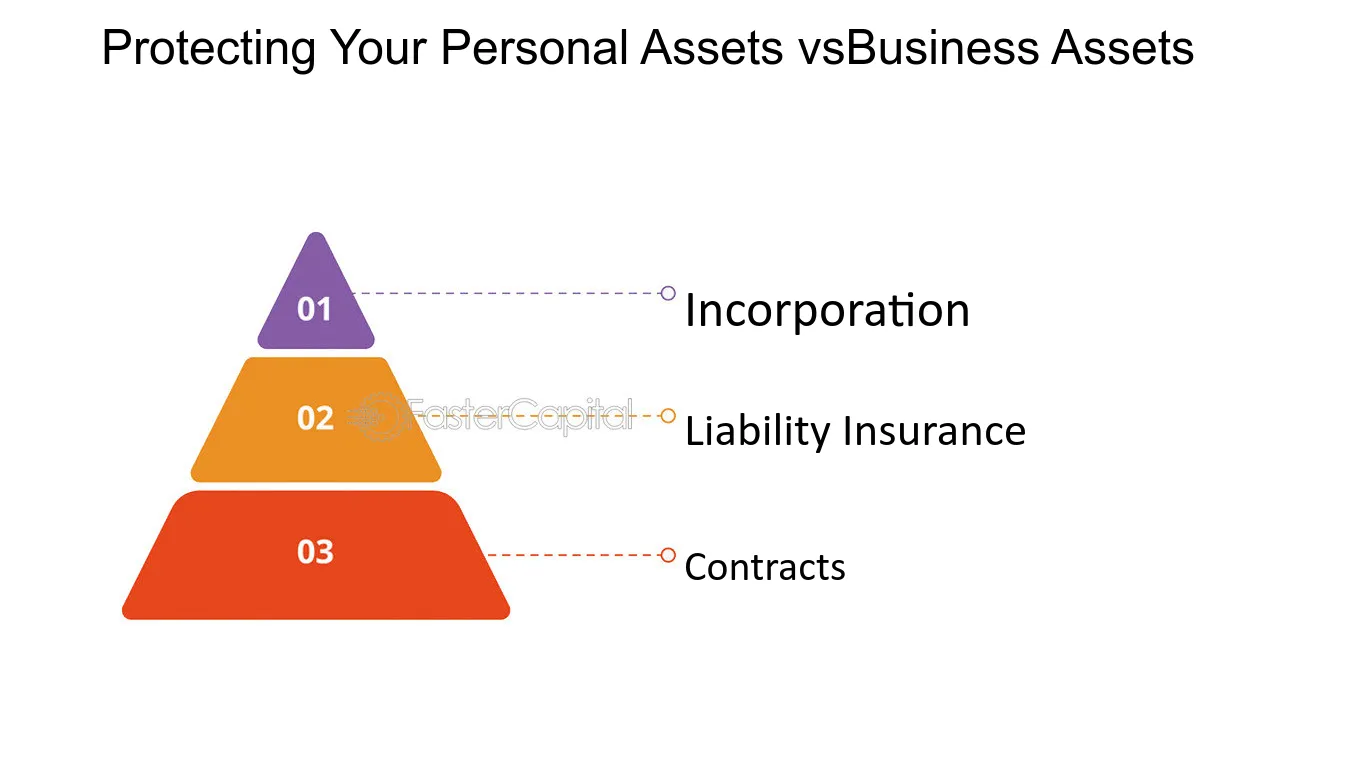

- Liability Protection: Personal business insurance can protect your personal assets, such as your home or savings, from lawsuits or claims arising from your business activities.

- Peace of Mind: Knowing you have insurance in place can provide you with peace of mind and reduce stress.

- Professional Reputation: Insurance can help to protect your professional reputation in the event of a claim.

Common Types of Personal Business Insurance:

- General Liability Insurance: Covers bodily injury, property damage, and personal injury claims arising from your business operations.

- Professional Liability Insurance: Protects you from claims of negligence or mistakes in your professional services.

- Home-Based Business Insurance: Provides coverage for business-related activities conducted from your home.

- Commercial Auto Insurance: Protects your business vehicles from accidents and liability claims.

Factors Affecting Personal Business Insurance Premiums:

- Type of Business: The nature of your business will significantly impact your premiums.

- Business Size: Larger businesses may face higher premiums due to increased potential risks.

- Location: Your business location can affect premiums, as some areas have higher rates of claims.

- Claims History: A history of claims may lead to higher premiums.

Choosing the Right Personal Business Insurance:

- Assess Your Needs: Determine the specific risks your business faces and choose coverage accordingly.

- Compare Policies: Obtain quotes from multiple insurers to find the best value.

- Read the Fine Print: Carefully review the terms and conditions of your policy to ensure it meets your needs.

Personal business insurance is an essential tool for protecting your personal assets and maintaining your professional reputation. By understanding the different types of coverage available and choosing the right policy, you can safeguard your business and your financial well-being.